Find high quality middle market businesses for sale

Join the thousands of M&A professionals using PrivSource to source buyout and investment opportunities in lower middle market businesses.

How it works

Spend more time

closing deals

Leverage PrivSource to find private companies for sale. Unlike public listing marketplaces, PrivSource is only available to vetted lower and middle market M&A professionals.

-

Family Offices

Family Offices -

Private Equity

Private Equity -

Traditional Searchfunds

Traditional Searchfunds -

Strategic Buyers

Strategic Buyers -

M&A Advisors

M&A Advisors -

Sellside Investment Banks

Sellside Investment Banks

Private businesses for

sale across North America

Leverage PrivSource’s private network to find private companies for sale. Unlike public business listing sites, PrivSource is only available to vetted lower and middle-market M&A professionals.

Vetted companies

and vetted members

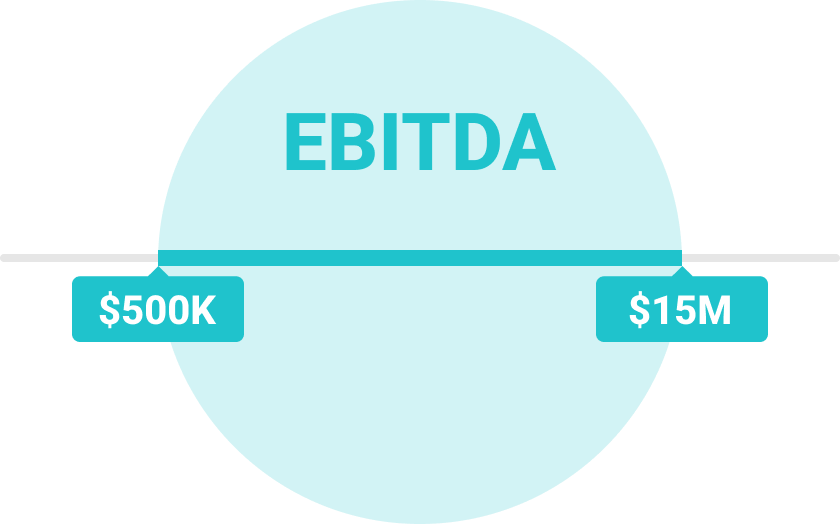

Our sweet spot is businesses that have $500K-$15M in annual EBITDA.

Closed and Secure

Thousands of firms and intermediaries across the lower middle market M&A ecosystem use PrivSource to source and list buyout opportunities.

PrivSource was a game changer. Of all the sourcing tools we tried, PrivSource had the best deals, the widest range of intermediaries, and the most reasonable fee structure (no acquisition fee).

Chris Sykes

Managing Director, Eagle Rock Capital

Trying to find good deals is difficult. PrivSource takes all the great deals available and consolidated them into one place and makes it easy to search for specific criteria. It makes sourcing deals extremely easy and cost-effective.

Todd Burdon

Executive Director, Rhyno Equity Group

Anyone sourcing via intermediaries or non-proprietary outreach will benefit from the amount of time the platform saves you during the week. The sell-side reps I’ve dealt with (bankers/brokers/advisors) have all produced quality materials and there hasn’t been one instance ‘haggling’ for basic data.

Matthew Hogan

Managing Partner, Needham Heights Holdings

FAQs

What is PrivSource?

PrivSource is a fully vetted M&A deal platform targeting the lower middle market. In order to join the platform, all members need to apply for access. We require that buyside members have an operating or investing background and access to funds available for an acquisition. We also vet all engagements that our sellside members post, in order to maintain a high quality deal platform. In order to qualify, an opportunity needs to exhibit > $5mm in annual revenue OR $500k in EBITDA. We do occasionally make exceptions if the opportunity exhibits high quality characteristics such as high margins, SaaS business model, niche market, etc. We’re industry agnostic and currently offer coverage in the US and Canada.

How does PrivSource source opportunities?

With our background as investors in the market, we’ve established a network of high quality deal flow with M&A advisors, bankers, and high quality brokers who want to better reach high quality buyers. Most of our deal flow on the platform comes from the hundreds of sellside groups and users that have signed up on the platform. We also leverage technology to curate publicly available listings from hundreds of sources, so you do not have to scour additional marketplaces and listing sites. As a result, we offer a solution that combines high quality public listings with engagements that you won’t find anywhere else.

Is PrivSource like Axial or BizBuySell?

Sort of. We offer a deal platform similarly to these websites. However, unlike Axial we do not charge fees on any deal that is sourced through the platform. We also do not match buyers based on fit or criteria. Instead, we fully vet anyone before they are given access to the platform, so they can opportunistically look for deals once they have access. As a result, we offer higher quality opportunities than BizBuySell.

Is PrivSource right for me/my firm?

The short answer is it depends. We offer value to buyers/intermediaries looking to acquire/exit in a virtual market, through a less traditional M&A process. Our buyside members consist of private equity firms, single family offices, independent sponsors, traditional search funds, and strategic M&A groups. Our sellside members consist of investment bankers, M&A advisors, and high quality brokers.

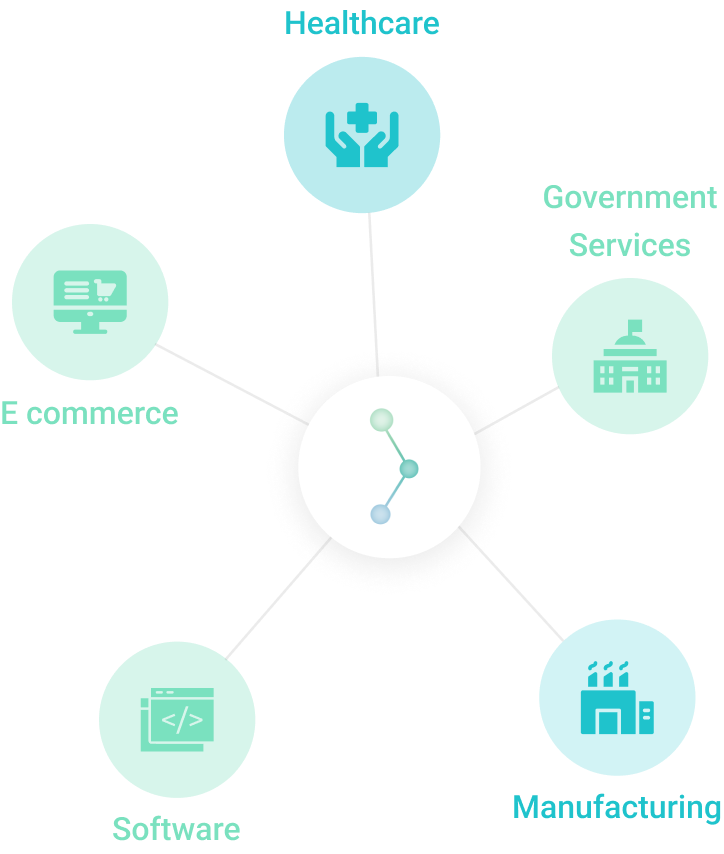

What industries/regions does the platform cover?

We currently cover the US and Canadian markets. We’re industry agnostic. We have members searching for software, HVAC, and everything in between.

What type of engagements does PrivSource offer?

We focus on majority and 100% buyout opportunities.

Does PrivSource charge sellside referral/success fees?

We do not charge fees. Ever. We make money off of a monthly subscription membership that the buyside pays in order to access our deal platform. See pricing for details.

Can I cancel my subscription anytime?

Yes. Your subscription is month-to-month, so you can cancel and reactivate your plan anytime.