Find the right buyers. Discover the right deals.

PrivSource combines AI powered buyer discovery with a private M&A deal network for the lower middle market.

AI Powered Buyer Lists

Private M&A Deal Network

Join 5,000+ deal professionals who trust our platform

Trusted by Dealmakers

An open letter from our founder:

Why we built PrivSource – and where it's going

In M&A, speed and precision matter. But building the right buyer list still feels like guesswork — hours spent stitching together spreadsheets, bouncing between databases, LinkedIn tabs, and past deals. It's slow. It's manual. And too often, it misses the mark.

We built PrivSource to change that.

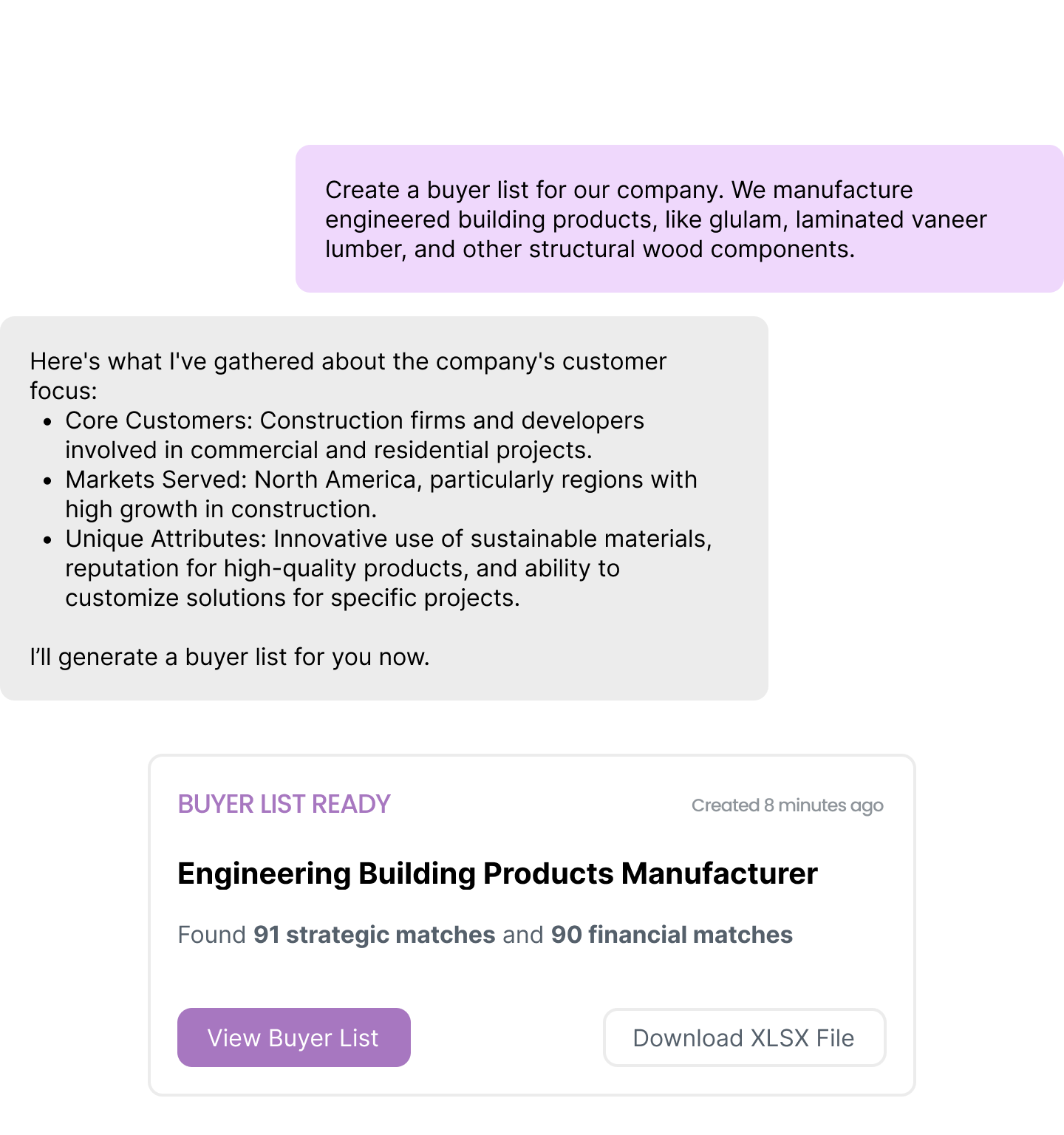

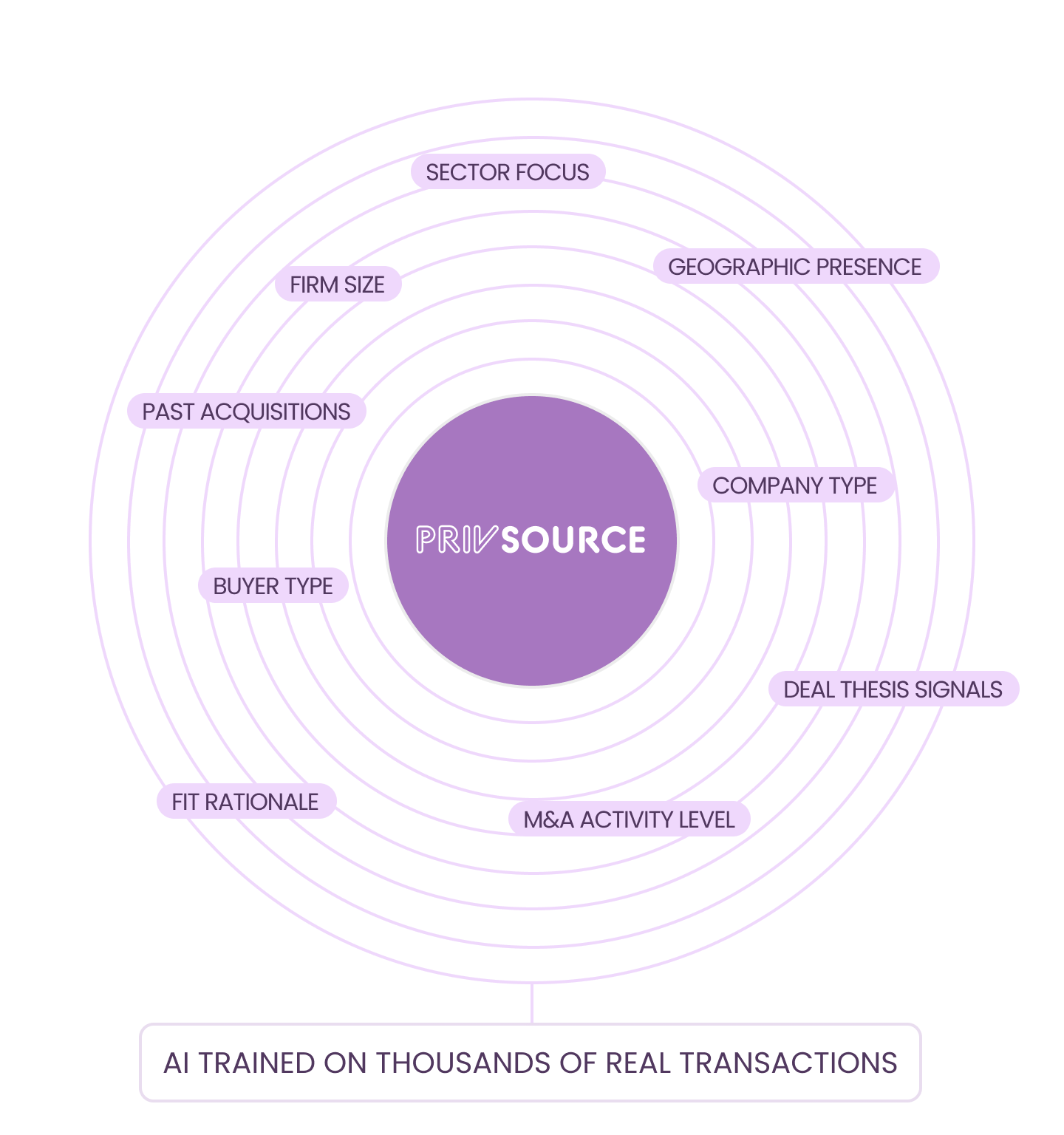

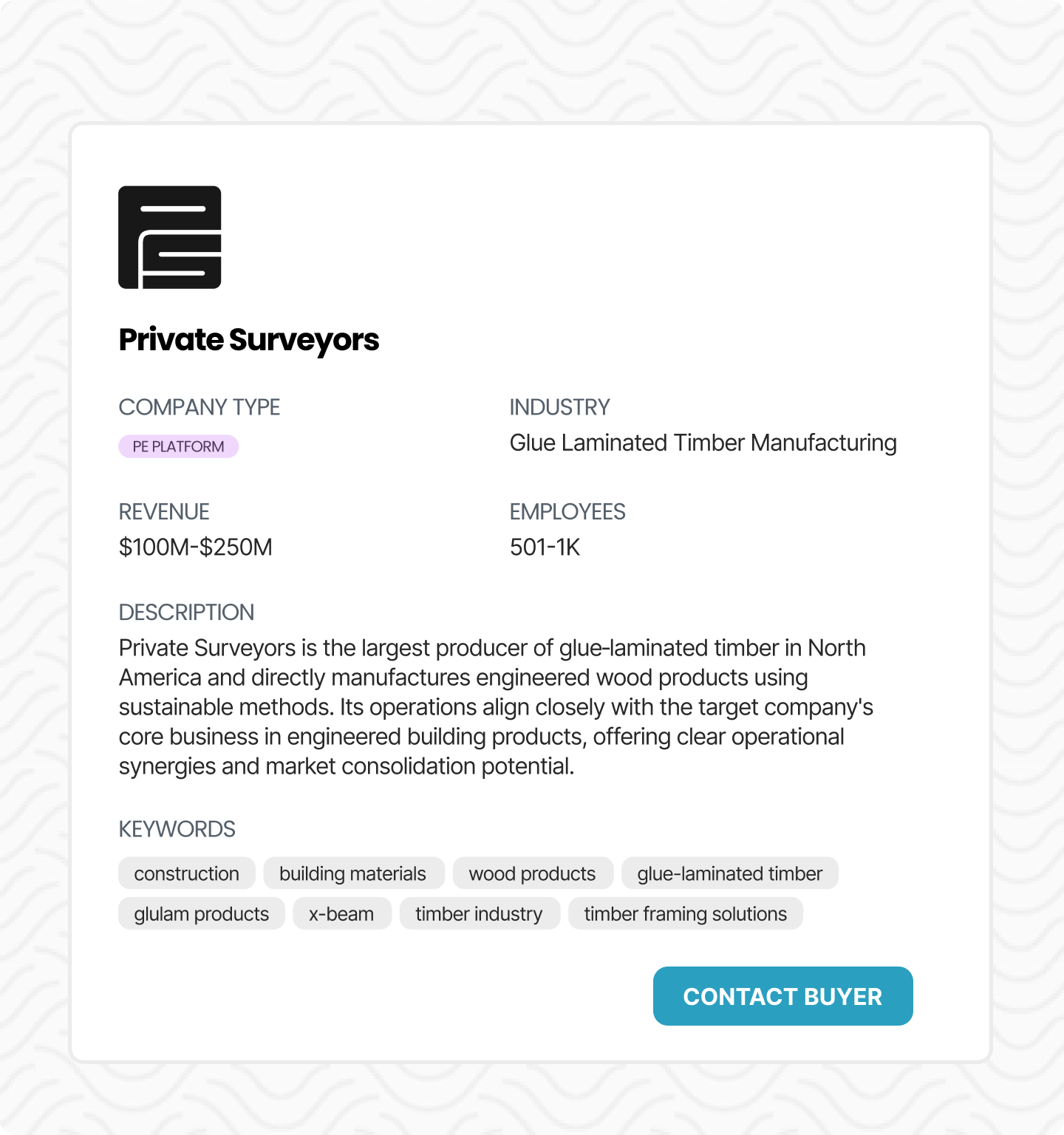

Our AI Researcher was trained on real M&A logic — not just industry codes and surface-level keywords. It understands strategic fit. It thinks the way dealmakers do. That means in minutes, you can generate a smart, defensible buyer list that feels like it came from a seasoned associate — because it did.

But that's just one side of the platform.

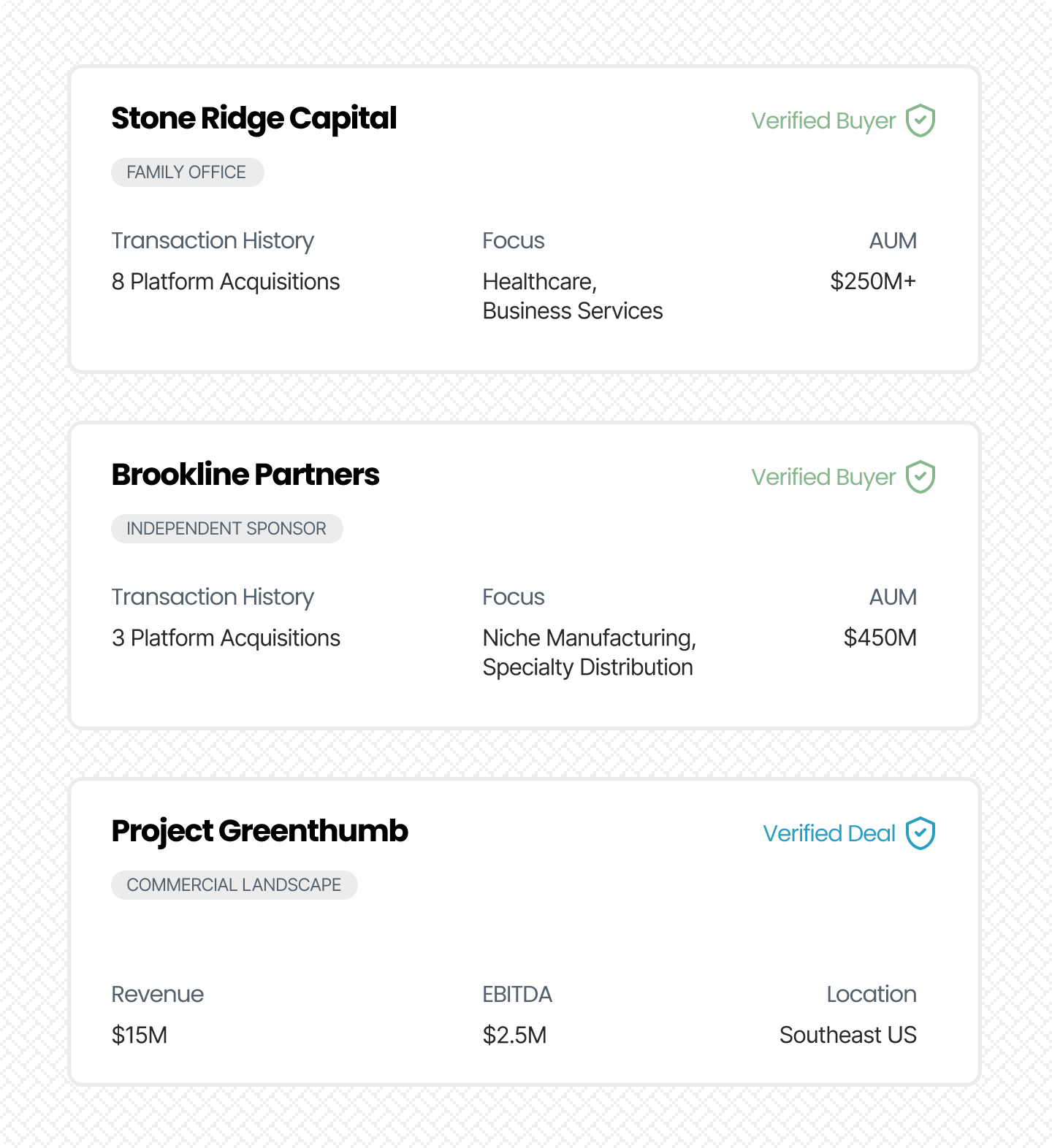

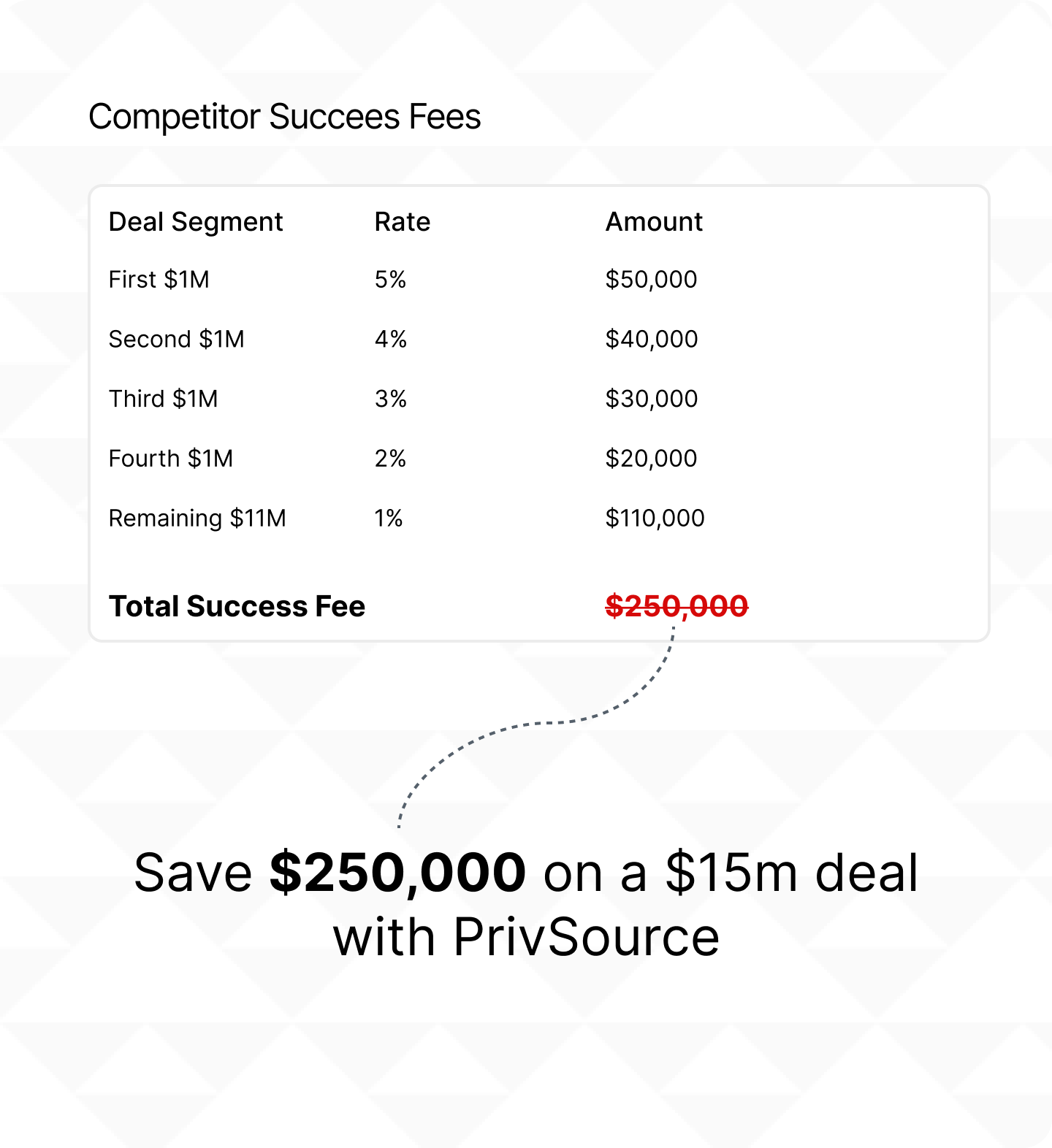

PrivSource also connects you to a private deal network — a vetted space for serious professionals to quietly share and review lower middle-market deals. No noise. No success fees. Just real opportunities.

The future of M&A research isn't about working harder. It's about working smarter — with tools that think with you, not just for you.

That's what we're building. And we're just getting started.

Find the most relevant buyers in minutes with AI

An AI-powered M&A assistant built for sell-side advisors and bankers.

An AI-powered M&A assistant built for sell-side advisors and bankers.

Access vetted deals from trusted professionals — without the noise or success fees.

Connects serious M&A professionals with qualified buyers and sell-side mandates in the lower middle market.

Connects serious M&A professionals with qualified buyers and sell-side mandates in the lower middle market.

How PrivSource works

Quickly find the right buyer – or the right deal

Create your free account

Join a vetted M&A network built for lower middle market dealmakers. No credit card required.

Select your role

Choose buy-side or sell-side during signup to tailor the experience to your workflow.

SELL SIDE

For Brokers, M&A Advisors, and Investment Banks

BUY SIDE

For Private Equity, Family Office, Independent Sponsor, Search Funds, and Corporate M&A teams.

Start Sourcing

Choose buy-side or sell-side during signup to tailor the experience to your workflow.

SELL SIDE

Generate AI-powered buyer lists or list deals to our private network.

BUY SIDE

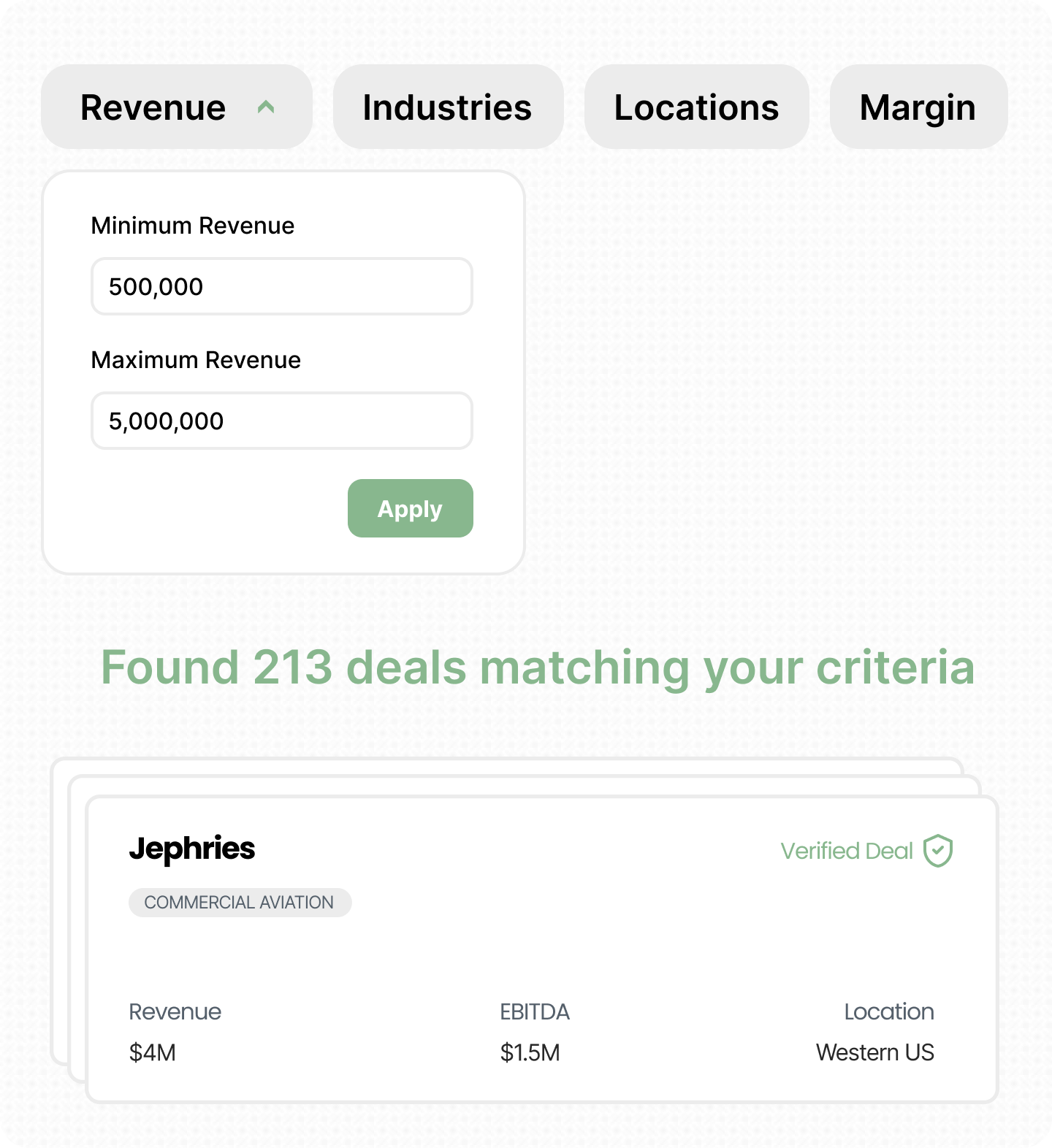

Browse live, lower middle market deals.

Who PrivSource is for

Choose your path and unlock the right tools for your M&A workflow

Buyers

Lower middle market deals. No success fees.

Private Equity Groups

Investing out of a committed fund? Uncover add-on and platform opportunities.

Family Offices

Private groups with $25M+ in assets gain direct access to vetted investment opportunities.

Independent Sponsors

Sourcing on a deal-by-deal basis? Streamline your process with consistent, relevant deal flow.

Traditional Search Funds

Backed by a group of investors? Identify acquisition targets aligned with your thesis.

Corporate M&A Teams

Strategic acquirers seeking tuck-ins or bolt-ons for horizontal or vertical growth.

Sellers

Build buyer lists with AI or share deals confidentially

M&A Brokers

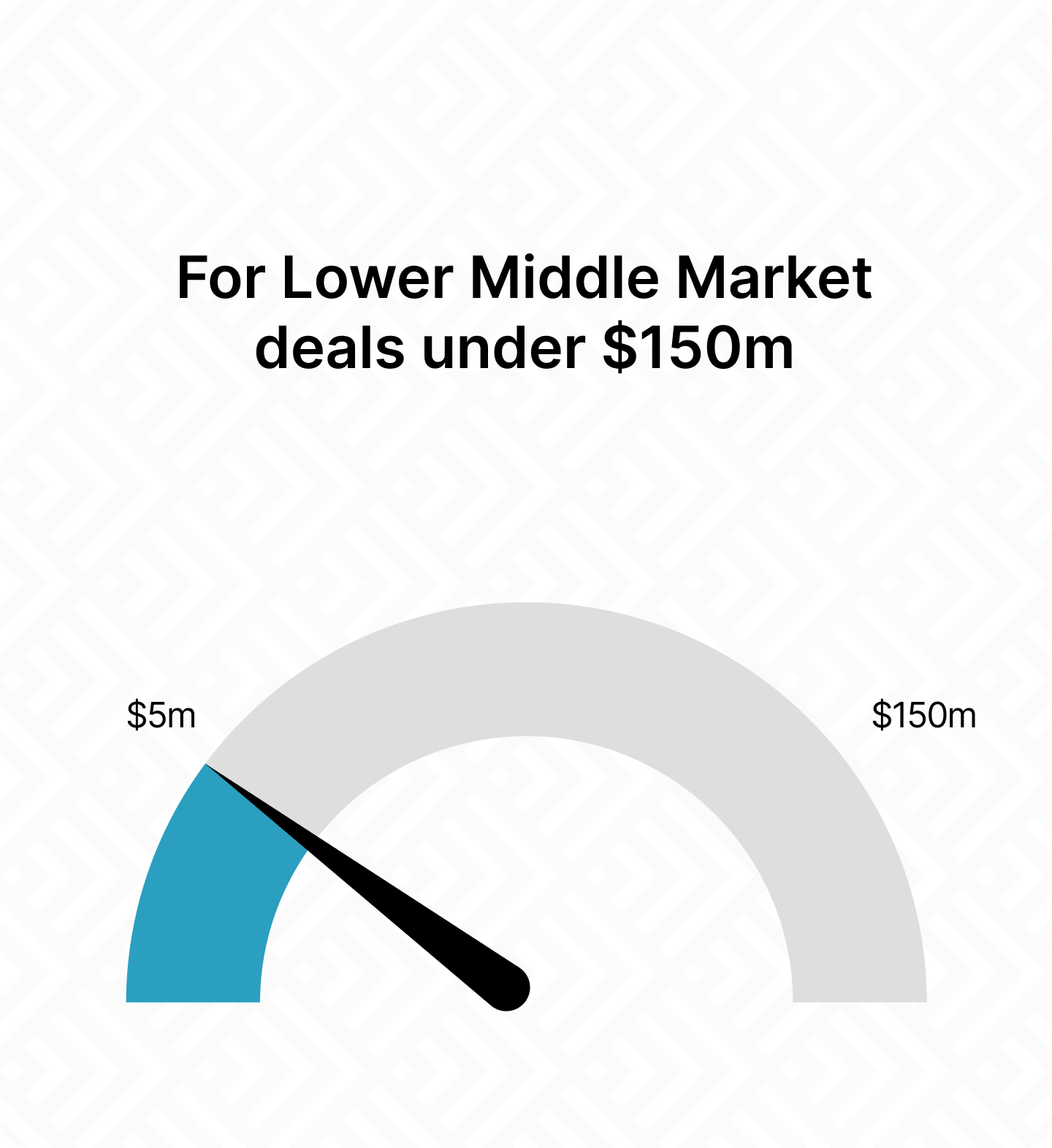

Representing business owners in $1M–$25M transactions. List deals discreetly through our private deal network — or use AI to find strategic buyers for larger or more complex engagements.

M&A Advisory Firms

Supporting founders or PE clients in $5M–$100M transactions. Use AI to identify strategic buyers and pressure-test your outreach — with more process rigor than a broker, less overhead than a bank.

Investment Banks

Use AI Researcher to build buyer lists, verify strategic fit, and surface new acquirers beyond your network. For smaller mandates, list deals through our private deal network to reach qualified buyers.

FAQs

What is PrivSource?

Deal Network is a private, curated marketplace of active buyout opportunities. All sell-side listings are vetted for quality, and all buy-side members are screened for acquisition experience and capital certainty, so sellers connect only with serious, credible buyers.

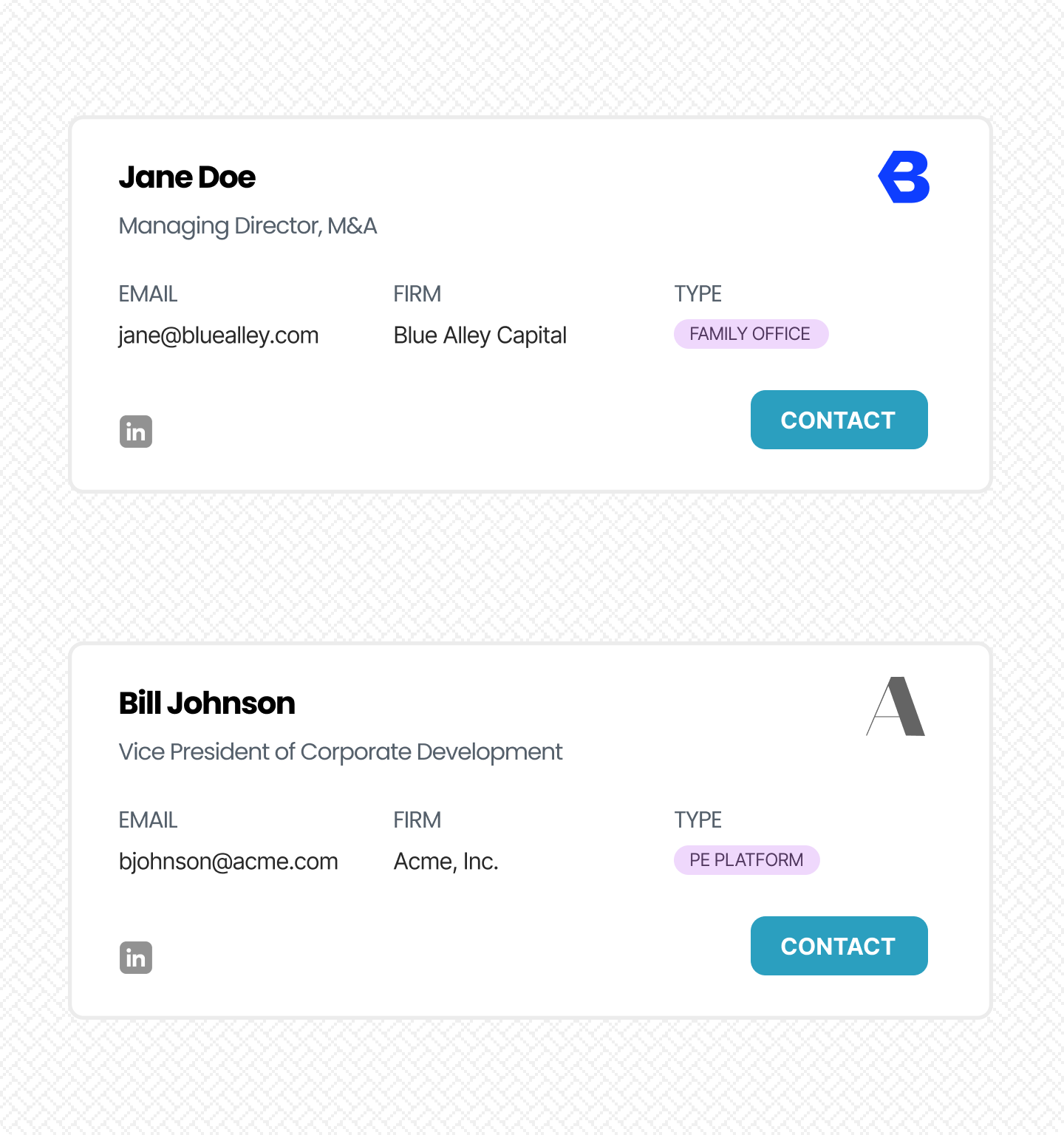

AI Researcher is an M&A-trained AI agent that instantly builds strategic buyer lists tailored to your deal. It is trained on real transactions and understands what makes a buyer a true fit, going far beyond basic keyword matching or static databases.

Our members include private equity firms, family offices, investment bankers, independent sponsors, strategic acquirers, and experienced M&A advisors. We're industry agnostic and currently support coverage across the U.S. and Canada. All members must apply and be approved before gaining access.

How does PrivSource source opportunities?

Deal Network also aggregates select opportunities from public marketplaces and partner firms, giving buyers additional exposure to curated listings without needing to search across multiple sources.

AI Researcher supports sell-side professionals by identifying strategic buyers tailored to each specific deal, using AI trained on real M&A transactions to go beyond basic keyword matching and surface true fit.

This combination of member-submitted deals and intelligent buyer discovery creates a more targeted, high-quality experience than traditional listing platforms.

Is PrivSource like Axial or BizBuySell?

We don't charge success fees and we don't act as hands-on matchmakers. Instead, we provide a high-quality, self-directed platform where vetted buyers and sellers can connect directly.

Every member is screened before gaining access, ensuring a more credible and efficient marketplace.

Compared to BizBuySell, our deals are typically more substantial and professionally represented, coming from vetted advisors. Compared to Axial, we offer greater flexibility and intelligence. AI Researcher is the first AI agent built specifically for M&A — helping advisors instantly generate targeted buyer lists by analyzing real transaction patterns across the broader M&A ecosystem, not just within a private network.

Is PrivSource right for me/my firm?

Buy-side users include private equity firms, family offices, independent sponsors, strategic acquirers, and search funds.

Sell-side users include investment bankers, M&A advisors, and quality business brokers.

Whether you're sourcing deals or buyers, we help you move faster and discover better-fit opportunities.